Project financing is an innovative and timely financing technique

that has been used on many high-profile corporate projects.

It is a method of financing very large capital intensive projects,

with long gestation period, where the lenders rely on the assets created for

the project as security and the cash flow generated by the project as source of funds

for repaying their dues. Increasingly, project financing is emerging as the preferred

alternative to conventional methods of financing infrastructure and other large-scale projects worldwide.

Project Financing discipline includes understanding the rationale for project financing,

how to prepare the financial plan, assess the risks, design the financing mix, and raise the funds.

In addition, one must understand the cogent analyses of why some project financing

plans have succeeded while others have failed. A knowledge-base is required

regarding the design of contractual arrangements to support project financing;

issues for the host government legislative provisions,

public/private infrastructure partnerships, public/private financing structures; credit requirements of lenders,

and how to determine the project's borrowing capacity; how to prepare cash flow projections and use

them to measure expected rates of return; tax and accounting considerations; and analytical techniques to validate the project's feasibility

Project finance is different from traditional forms of finance because the financier

principally looks to the assets and revenue of the project in order to secure and service the loan.

In contrast to an ordinary borrowing situation, in a project financing the financier usually has little or

no recourse to the non-project assets of the borrower or the sponsors of the project. In this situation,

the credit risk associated with the borrower is not as important as in an ordinary loan transaction;

what is most important is the identification, analysis, allocation and management of every risk associated with the project.

In a no recourse or limited recourse project financing, the risks for a financier are great.

Since the loan can only be repaid when the project is operational,

if a major part of the project fails, the financiers are likely to lose a substantial amount of money.

The assets that remain are usually highly specialised and possibly in a remote location. If saleable,

they may have little value outside the project. Therefore, it is not surprising that financiers, and their advisers,

go to substantial efforts to ensure that the risks associated with the project are reduced or eliminated as far as possible.

It is also not surprising that because of the risks involved, the cost of such finance is generally higher and it is more time

consuming for such finance to be provided.

Risk Minimisation Process :

Financiers are concerned with minimising the dangers of any events which could have a

negative impact on the financial performance of the project, in particular,

events which could result in: (1) the project not being completed on time, on budget,

or at all; (2) the project not operating at its full capacity; (3) the project failing

to generate sufficient revenue to service the debt; or (4) the project prematurely coming to an end.

The minimisation of such risks involves a three step process.

The first step requires the identification and analysis of all the risks

that may bear upon the project. The second step is the allocation of those risks among the parties.

The last step involves the creation of mechanisms to manage the risks.

STEP 1 - Risk Identification and Analysis

The project sponsors will usually prepare a feasibility study, e.g. as to the construction

and operation of a mine or pipeline. The financiers will carefully review the study and may

engage independent expert consultants to supplement it. The matters of particular focus will be whether

the costs of the project have been properly assessed and whether the cash-flow streams from the project

are properly calculated. Some risks are analysed using financial models to determine the project's cash-flow

and hence the ability of the project to meet repayment schedules. Different scenarios will be examined by

adjusting economic variables such as inflation, interest rates, exchange rates and prices for the inputs and output of the project

. Various classes of risk that may be identified in a project financing will be discussed below.

STEP 2 - Risk Allocation

Once the risks are identified and analysed, they are allocated by the parties through negotiation of the contractual framework.

Ideally a risk should be allocated to the party who is the most appropriate to bear it

(i.e. who is in the best position to manage, control and insure against it) and who has the financial capacity to bear it.

It has been observed that financiers attempt to allocate uncontrollable risks widely and to ensure

that each party has an interest in fixing such risks. Generally, commercial risks are sought to be allocated to

the private sector and political risks to the state sector.

STEP 3 - Risk Management

Risks must be also managed in order to minimise the possibility of the risk event

occurring and to minimise its consequences if it does occur. Financiers need to ensure that

the greater the risks that they bear, the more informed they are and the greater their control over the project.

Since they take security over the entire project and must be prepared to step in and take it over if the borrower defaults.

This requires the financiers to be involved in and monitor the project closely. Such risk management is facilitated

by imposing reporting obligations on the borrower and controls over project accounts. Such measures may

lead to tension between the flexibility desired by borrower and risk management mechanisms required by the financier.

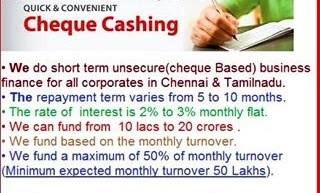

We offers comprehensive range of products and services to meet all financial needs. This will enable you to enhance cash

flows and reduce financing costs, to build your financial strength and help you develop as a business enterprise.

We Arrange to Provide Project Finance for different kind of Projects such as :

Project Financing, whether start up or Existing Project

Asset Based funding

Communications

Computer Related

Consumer Products

Cultural Industry Related (Shows and Plays)

Distributions

Early Stage Equity Funding

Electronic Components-Instrumentations

Energy (Various Type)

Financial Services

Hotels Motels, Resorts

Leverage Buy Out

Management Buy Out

Manufacturing (Various type)

Medical / Health

Movie Picture Financing

Publishing (Various type)

Real Estate Projects (Various)

Research and Development Equity Funding

Retail (Various type)

Seed Capital

Technology (Various type)

Waste Management

Others

Industrial and Manufacturing Plant, Existing or Start Up.